Bitcoin has swung wildly over the last week as traders scramble to get ahead of a “crisis scenario” for the bitcoin price.

The bitcoin price has dropped to lows not seen since early November, with panicky crypto holders urged to avoid a mystery threat.

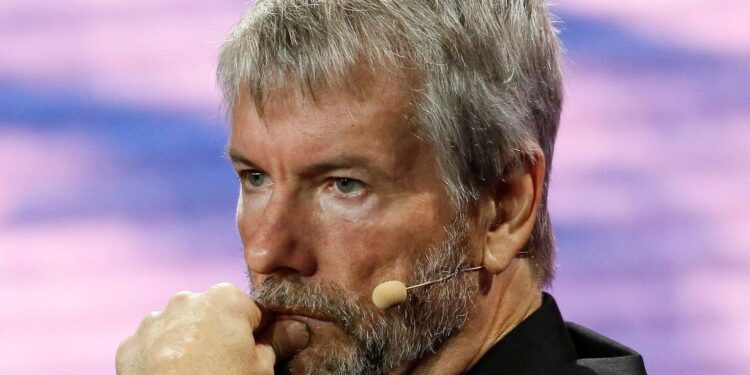

Now, as Wall Street giants stare down the barrel of an “existential” bitcoin and crypto game-changer, Michael Saylor’s software company-turned-bitcoin buyer Strategy has warned it could be forced to sell some of its bitcoin to meet its financial obligations.

Sign up now for the free CryptoCodex—A daily five-minute newsletter for traders, investors and the crypto-curious that will get you up to date and keep you ahead of the bitcoin and crypto market bull run

Forbes‘Flood The Market’—‘Major’ Fed Flip Predicted To Blow Up The Bitcoin PriceBy Billy Bambrough

Strategy founder Michael Saylor has gathered $42 billion worth of bitcoin, riding the bitcoin price … More rally into the Nasdaq 100 index.

“As bitcoin constitutes the vast bulk of assets on our balance sheet, if we are unable to secure equity or debt financing in a timely manner, on favorable terms, or at all, we may be required to sell bitcoin to satisfy our financial obligations, and we may be required to make such sales at prices below our cost basis or that are otherwise unfavorable,” a Strategy regulatory filing read.

Strategy said it’s expecting to record a near-$6 billion unrealized loss for the first quarter, despite a related $1.69 billion income tax benefit, and warned it might not be able to regain profitability in future quarters, especially if the value of its bitcoin continues to plummet.

“A significant decrease in the market value of our bitcoin holdings could adversely affect our ability to satisfy our financial obligations,” the filing added.

Sign up now for CryptoCodex—A free, daily newsletter for the crypto-curious

The bitcoin price has fallen sharply, dropping along with stock markets.

Strategy’s stock price has almost halved since soaring to its November peak that saw it inducted into the prestigious Nasdaq 100 index.

Strategy, which currently owns almost 530,000 bitcoin worth nearly $42 billion that were bought for an average of $67,000 per bitcoin, has fuelled its bitcoin buys by selling convertible bonds and issuing stock.

At the end of March, Strategy held around $8 billion worth of debt on which it owes about $35 million per year in interest on top of almost $150 million it must pay every year in dividends on its stock.

Meanwhile, crypto analysts are desperately trying to predict where the market is headed next, with one closely-watched analyst issuing a bitcoin price prediction that would see bitcoin crash back to around $10,000.

“Everyone’s in for the long-term, as long as it’s going up,” Bloomberg Intelligence senior commodity strategist Mike McGlone, wrote in a report posted to X. “[I] did not know how bitcoin was going to get to $100,000 from $10,000 in 2020, but the trends showed up. Now, I see the reversion path back toward $10,000.”