Topline

Several notable billionaires experienced massive hits to their fortunes Monday as the Chinese generative artificial intelligence startup DeepSeek upended the U.S. stock market, hitting the American AI leader Nvidia the hardest.

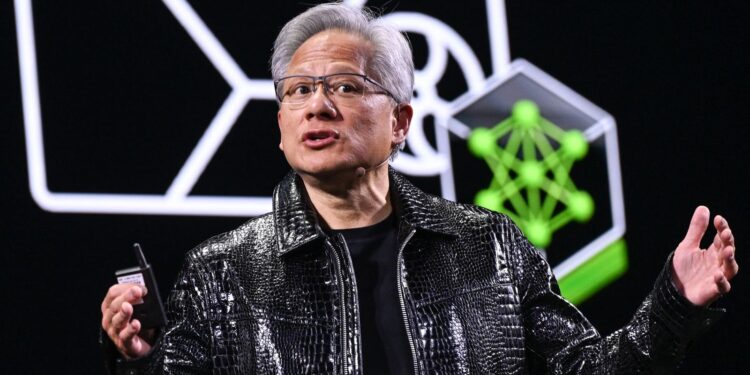

Nvidia CEO Jensen Huang speaks at CES 2025.

Key Facts

As Nvidia shares tanked 17% and the company lost a record $589 billion in market capitalization, the net worth of its CEO and biggest individual shareholder, Jensen Huang, dove, falling $20.8 billion by market close.

Huang’s fortune slide from $124.4 billion to $103.7 billion knocked him from the 10th spot on Forbes’ real-time billionaires ranking to 17th, slipping behind Spanish fast fashion mogul Armancio Ortega, Walmart heirs Rob Walton, Jim Walton and Alice Walton, Microsoft cofounder Bill Gates, Dell CEO Michael Dell and former New York mayor Michael Bloomberg.

Rivaling Huang’s percentage drop Monday was a $27.6 billion loss for Oracle chairman Larry Ellison, as Oracle stock tanked 14% — Ellison fell from third-richest person on Earth to fifth, falling behind Meta CEO Mark Zuckerberg and LVMH luxury tycoon Bernard Arnault.

Nvidia and Oracle were among several Big Tech losers Monday as DeepSeek’s large-language model that was reportedly developed for a fraction of its American competitors like OpenAI’s ChatGPT sent questions about whether companies will continue to spend lavishly on the technology necessary to power and train generative AI.

10 Biggest Billionaire Losers Monday

- Oracle chairman Larry Ellison (net worth down $27.6 billion)

- Nvidia CEO Jensen Huang ($20.8 billion)

- Dell CEO Michael Dell ($12.4 billion)

- Google cofounder Larry Page ($6.3 billion)

- Google cofounder Sergey Brin ($5.9 billion)

- Early Google investor Andreas von Bechtolsheim ($5.4 billion)

- Tesla CEO Elon Musk ($5.3 billion)

- Interactive Brokers chairman Thomas Peterffy ($4.1 billion)

- Broadcom chairman Henry Samueli ($3.7 billion)

- Broadcom cofounder Henry Nicholas III ($2.8 billion)

Contra

Monday was largely a brutal day for American tech stocks, but there was one notable exception, Apple, whose shares rose more than 3%. Apple’s move against the broader market losses was likely a result of its less-intense AI spending push than its Big Tech peers. Class B shares of Berkshire Hathaway, Warren Buffett’s conglomerate, rose 2.5% as its largest investment by market value (its 2% stake in Apple) got a boost, making Buffett the largest American billionaire winner Monday with a $2.3 billion windfall. Apple’s billionaire CEO Tim Cook got $23 million richer and the net worth of Laurene Powell Jobs, the philanthropist widow of Apple cofounder Steve Jobs, rose by $289 million.

Key Background

American stocks broadly struggled Monday, as the S&P 500 fell 1.5% and the tech-heavy Nasdaq slipped 3.1%, with much of the index losses stemming from Nvidia and other Big Tech companies’ nosedives. DeepSeek’s generative AI model rivaling OpenAI’s ChatGPT and Google’s Gemini was trained on just $5.6 million worth of Nvidia’s graphics processing units, according to DeepSeek, a sum which the likes of Bernstein analyst Stacy Rasgon insist is a gross underestimate, though it opened the door for advanced AI using far less of the pricey technology sold by Nvidia. Other than the Nvidia-specific potential for less GPU sales as AI models advance, the DeepSeek drama also brought into question the high valuations enjoyed by America’s biggest companies stemming from the largely U.S.-centric generative AI revolution, which now features a major Chinese challenger in DeepSeek.