Elon Musk holds an outsized influence in the new Trump administration.

As head of his Department of Government Efficiency, or DOGE, the world’s wealthiest man has enjoyed nearly unfettered political power in slashing and refashioning the federal government as he sees fit. And it has quickly become clear that he has the president’s ear on issues beyond that brief.

But on one topic, Musk stands somewhat apart from others in the coterie of aides and advisers around Trump: China. In contrast to the many hawks in the new Trump cabinet who call for a hard-line approach on China, Musk is a striking outlier.

As an expert on China-U.S. relations who has monitored Musk’s views on China, I don’t find his long history of espousing pro-Chinese sentiment surprising, given that he has sought throughout to get a business hold in the country.

But those entanglements are worth scrutiny, given Musk’s role in the Trump administration at a time when one of America’s biggest foreign policy challenges is how to manage its relationship with Beijing.

Musk’s journey to the East

For years, Musk has had significant business interests in China, with Tesla’s Shanghai factory, Tesla Giga Shanghai, playing a crucial role in the company’s global operations.

Since its opening in 2019, the Shanghai plant has surpassed Tesla’s Fremont, California, facility in both size and productivity, now accounting for more than half of the company’s global deliveries and a majority of its profits. Moreover, nearly 40% of Tesla’s battery supply chain relies on Chinese companies, and these partnerships continue to expand.

STR/AFP via Getty Images

Notably, Tesla was the first foreign automaker permitted to establish operations in China without a local partner, following a change in ownership regulations. The Shanghai factory was constructed with the support of US$1.4 billion in loans from Chinese state-owned banks, granted at favorable interest rates.

Between 2019 and 2023, the Shanghai government also provided Tesla with a reduced corporate tax rate of 15% – 10 percentage points lower than the standard rate.

The cost advantages of manufacturing in Shanghai, which include lower production and labor expenses, have further cemented Tesla’s reliance on the Chinese market.

Given that Musk’s wealth is largely tied to Tesla stock, his financial standing is increasingly dependent on the company’s fortunes in China, making any potential disengagement from the country both economically and strategically challenging.

Tesla’s continued investment in China underscores this dependency. On Feb. 11, 2025, the company opened its second factory in Shanghai — a $200 million plant that is set to produce 10,000 megapack batteries annually. It’s the company’s first megapack battery factory outside the U.S..

This investment deepens Tesla’s presence in China amid a new wave of U.S.-China trade tensions. On Feb. 1, the Trump administration imposed a 10% tariff on Chinese imports, prompting Beijing’s retaliation with tariffs on American coal, liquefied natural gas, agricultural equipment and crude oil.

A Chinese fan

It remains unclear to what extent Musk’s financial interests in China will translate to real influence over the Trump administration’s policy toward Beijing. But Musk’s long history of pro-China remarks suggests the direction he wants the administration to move.

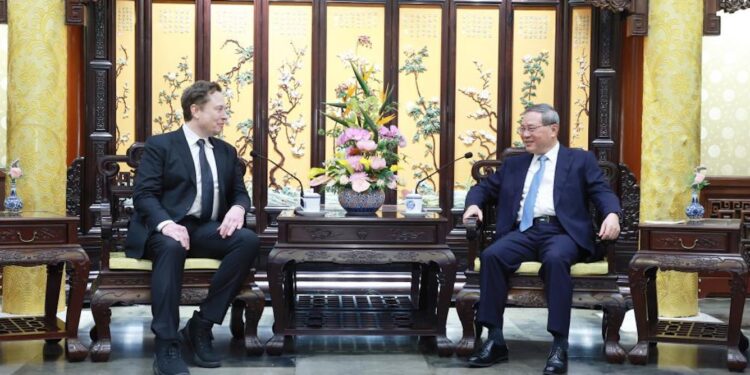

During his visit to Beijing in April 2024, Musk praised the country, noting also: “I also have a lot of fans in China – well, the feeling is mutual.”

His admiration appears to hinge in part on how he views business and labor practices in China. In that vein, Musk has criticized American workers as lazy and has faced U.S. labor law disputes, while simultaneously praising Chinese workers for “burning the 3 a.m. oil” under an intensely repressive labor system.

In numerous posts on the social media platform X, formerly Twitter, which he owns, Musk has also praised China’s infrastructure and high-speed rail system, lauded its space program, applauded its leadership in global green energy initiatives and urged his followers to visit the country.

Musk has also opposed U.S. efforts to decouple from China, describing the countries’ economies as “conjoined twins,” despite a sizable part of the foreign policy establishment in the West viewing decreased dependency on China as necessary for security interests amid rising geopolitical tensions.

On the issue of Taiwan, the most dangerous flashpoint in U.S.-China relations, Musk has compared Taiwan to Hawaii, arguing that it is an integral part of China and noting that the U.S. Pacific Fleet has prevented mainland China from achieving reunification by force.

Musk further suggested that the Taiwan dispute could be resolved by allowing China to establish Taiwan as a special administrative zone, similar to Hong Kong.

His remarks were shared and welcomed by China’s then-ambassador to the U.S., who, in a post on X, emphasized China’s so-called peaceful unification strategy and advocated for the “one country, two systems” model.

Trump’s back-channel envoy?

The big question going forward is how Musk’s financial stakes in, and stated admiration for, China will translate into attempts to influence the U.S. administration’s China policy, particularly given Musk’s unconventional advisory role and the strong faction of anti-China hawks in Trumpworld.

Given Musk’s approach to China, it’s hard to see him not trying to use his influence with the president to push for somewhat warmer relations with Beijing.

If such counsel were heeded, it’s easy to envision Musk leveraging his deep ties to China, particularly his close personal relationship with China’s current second-ranking official, Premier Li Qiang, who was the Shanghai party chief when Tesla’s factory was built. In the scenario, Donald Trump could tap Musk as a back channel for diplomacy to ease U.S.-China tensions and facilitate bilateral cooperation when needed.

To this point, it was, perhaps, telling that it was Musk who met with China President Xi Jinping’s envoy to Trump’s inauguration, Vice President Han Zheng, on the eve of the event.

But it’s far from certain that Trump wants that diplomatic role for Musk, or that other voices won’t win out with regard to Beijing. In his first term, Trump launched an unprecedented trade war and tech blockade against China, fundamentally reshaping U.S.-China relations and pushing the U.S. toward something of a bipartisan consensus to counter Beijing that has existed for several years.

Trump’s tariff moves and second-term picks for top trade and commerce roles, like Peter Navarro and Jamieson Greer — who played key roles in the trade war against China during the president’s first term — suggest that Trump’s commitment to further decoupling from China remains strong.

Furthermore, Musk’s business interests and personal wealth tied to China could leave him vulnerable to Chinese influence. By leaning on Musk’s close ties with Trump, China could use his dependence on the Chinese market as a bargaining chip to pressure Trump into making concessions on issues of major strategic importance to Beijing.

China has a history of coercing foreign companies reliant on its market into making compromises on matters concerning its national interests. For instance, Apple removed virtual private network apps from its app store in China at the government’s request. Similarly, Tesla could face comparable pressure in the future if Beijing wants to use Musk as a cudgel to influence policy in the Trump administration. Notably, as the head of DOGE, with access to sensitive data from multiple agencies, Musk could find himself caught between U.S. security scrutiny and China’s strategic targeting.

So long as Musk retains the influence with Trump that he holds now, it’s conceivable that his pro-China sentiments will translate into attempts to influence government policy. Yet even if this is to be the case, whether those efforts succeed will depend on the president and his other advisers, many of whom are seeking an aggressive front against Beijing and are likely to view Musk as an impediment rather than ally in that fight to come.

Elon Musk holds an outsized influence in the new Trump administration.

As head of his Department of Government Efficiency, or DOGE, the world’s wealthiest man has enjoyed nearly unfettered political power in slashing and refashioning the federal government as he sees fit. And it has quickly become clear that he has the president’s ear on issues beyond that brief.

But on one topic, Musk stands somewhat apart from others in the coterie of aides and advisers around Trump: China. In contrast to the many hawks in the new Trump cabinet who call for a hard-line approach on China, Musk is a striking outlier.

As an expert on China-U.S. relations who has monitored Musk’s views on China, I don’t find his long history of espousing pro-Chinese sentiment surprising, given that he has sought throughout to get a business hold in the country.

But those entanglements are worth scrutiny, given Musk’s role in the Trump administration at a time when one of America’s biggest foreign policy challenges is how to manage its relationship with Beijing.

Musk’s journey to the East

For years, Musk has had significant business interests in China, with Tesla’s Shanghai factory, Tesla Giga Shanghai, playing a crucial role in the company’s global operations.

Since its opening in 2019, the Shanghai plant has surpassed Tesla’s Fremont, California, facility in both size and productivity, now accounting for more than half of the company’s global deliveries and a majority of its profits. Moreover, nearly 40% of Tesla’s battery supply chain relies on Chinese companies, and these partnerships continue to expand.

STR/AFP via Getty Images

Notably, Tesla was the first foreign automaker permitted to establish operations in China without a local partner, following a change in ownership regulations. The Shanghai factory was constructed with the support of US$1.4 billion in loans from Chinese state-owned banks, granted at favorable interest rates.

Between 2019 and 2023, the Shanghai government also provided Tesla with a reduced corporate tax rate of 15% – 10 percentage points lower than the standard rate.

The cost advantages of manufacturing in Shanghai, which include lower production and labor expenses, have further cemented Tesla’s reliance on the Chinese market.

Given that Musk’s wealth is largely tied to Tesla stock, his financial standing is increasingly dependent on the company’s fortunes in China, making any potential disengagement from the country both economically and strategically challenging.

Tesla’s continued investment in China underscores this dependency. On Feb. 11, 2025, the company opened its second factory in Shanghai — a $200 million plant that is set to produce 10,000 megapack batteries annually. It’s the company’s first megapack battery factory outside the U.S..

This investment deepens Tesla’s presence in China amid a new wave of U.S.-China trade tensions. On Feb. 1, the Trump administration imposed a 10% tariff on Chinese imports, prompting Beijing’s retaliation with tariffs on American coal, liquefied natural gas, agricultural equipment and crude oil.

A Chinese fan

It remains unclear to what extent Musk’s financial interests in China will translate to real influence over the Trump administration’s policy toward Beijing. But Musk’s long history of pro-China remarks suggests the direction he wants the administration to move.

During his visit to Beijing in April 2024, Musk praised the country, noting also: “I also have a lot of fans in China – well, the feeling is mutual.”

His admiration appears to hinge in part on how he views business and labor practices in China. In that vein, Musk has criticized American workers as lazy and has faced U.S. labor law disputes, while simultaneously praising Chinese workers for “burning the 3 a.m. oil” under an intensely repressive labor system.

In numerous posts on the social media platform X, formerly Twitter, which he owns, Musk has also praised China’s infrastructure and high-speed rail system, lauded its space program, applauded its leadership in global green energy initiatives and urged his followers to visit the country.

Musk has also opposed U.S. efforts to decouple from China, describing the countries’ economies as “conjoined twins,” despite a sizable part of the foreign policy establishment in the West viewing decreased dependency on China as necessary for security interests amid rising geopolitical tensions.

On the issue of Taiwan, the most dangerous flashpoint in U.S.-China relations, Musk has compared Taiwan to Hawaii, arguing that it is an integral part of China and noting that the U.S. Pacific Fleet has prevented mainland China from achieving reunification by force.

Musk further suggested that the Taiwan dispute could be resolved by allowing China to establish Taiwan as a special administrative zone, similar to Hong Kong.

His remarks were shared and welcomed by China’s then-ambassador to the U.S., who, in a post on X, emphasized China’s so-called peaceful unification strategy and advocated for the “one country, two systems” model.

Trump’s back-channel envoy?

The big question going forward is how Musk’s financial stakes in, and stated admiration for, China will translate into attempts to influence the U.S. administration’s China policy, particularly given Musk’s unconventional advisory role and the strong faction of anti-China hawks in Trumpworld.

Given Musk’s approach to China, it’s hard to see him not trying to use his influence with the president to push for somewhat warmer relations with Beijing.

If such counsel were heeded, it’s easy to envision Musk leveraging his deep ties to China, particularly his close personal relationship with China’s current second-ranking official, Premier Li Qiang, who was the Shanghai party chief when Tesla’s factory was built. In the scenario, Donald Trump could tap Musk as a back channel for diplomacy to ease U.S.-China tensions and facilitate bilateral cooperation when needed.

To this point, it was, perhaps, telling that it was Musk who met with China President Xi Jinping’s envoy to Trump’s inauguration, Vice President Han Zheng, on the eve of the event.

But it’s far from certain that Trump wants that diplomatic role for Musk, or that other voices won’t win out with regard to Beijing. In his first term, Trump launched an unprecedented trade war and tech blockade against China, fundamentally reshaping U.S.-China relations and pushing the U.S. toward something of a bipartisan consensus to counter Beijing that has existed for several years.

Trump’s tariff moves and second-term picks for top trade and commerce roles, like Peter Navarro and Jamieson Greer — who played key roles in the trade war against China during the president’s first term — suggest that Trump’s commitment to further decoupling from China remains strong.

Furthermore, Musk’s business interests and personal wealth tied to China could leave him vulnerable to Chinese influence. By leaning on Musk’s close ties with Trump, China could use his dependence on the Chinese market as a bargaining chip to pressure Trump into making concessions on issues of major strategic importance to Beijing.

China has a history of coercing foreign companies reliant on its market into making compromises on matters concerning its national interests. For instance, Apple removed virtual private network apps from its app store in China at the government’s request. Similarly, Tesla could face comparable pressure in the future if Beijing wants to use Musk as a cudgel to influence policy in the Trump administration. Notably, as the head of DOGE, with access to sensitive data from multiple agencies, Musk could find himself caught between U.S. security scrutiny and China’s strategic targeting.

So long as Musk retains the influence with Trump that he holds now, it’s conceivable that his pro-China sentiments will translate into attempts to influence government policy. Yet even if this is to be the case, whether those efforts succeed will depend on the president and his other advisers, many of whom are seeking an aggressive front against Beijing and are likely to view Musk as an impediment rather than ally in that fight to come.