What does the data show?

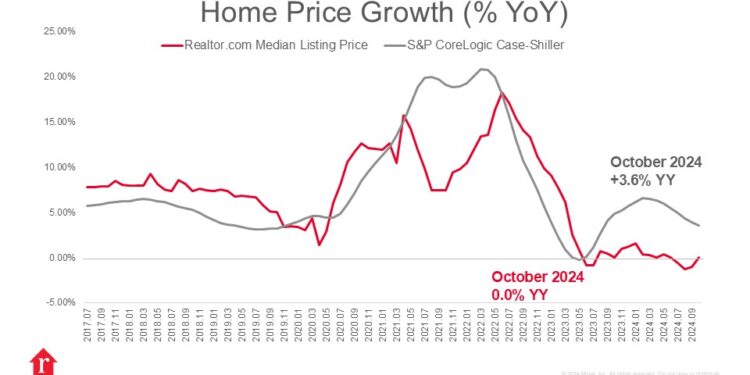

The S&P CoreLogic Case-Shiller Index picked up slightly in October, recording a 3.6% year-over-year gain in the prices of homes in the US. This is a bit below last month’s mark of 3.9% growth and comes in as the 7th consecutive month in which year-over-year gains have fallen. With that being said, the index also reached a new record high for the 17th month in a row. Home price appreciation seems to be settling into a more comfortable pace, just as inventory levels pick up going into 2025: welcome news for prospective buyers who continue to face the headwinds of high mortgage rates. The 10- and 20-City Composites behaved similarly to the national index, with the 10-City posting 4.8% year-over-year growth (down from 5.2% in the previous month) and the 20-City coming in at 4.2% (4.6% last month).

How did trends vary by region?

Home price appreciation varies significantly across the country. In the South and West regions, where housing inventory has nearly returned to pre-pandemic levels, the Case-Shiller Index shows markets like Tampa (+0.39%), Denver (+0.44%), and Dallas (+0.85%) with less than a percentage point of year-over-year price growth. Meanwhile in the Northeast and Midwest, markets like New York (+7.27%) and Chicago (+6.24%) are driving the national-level price growth. Home builders have taken notice of this trend, and are throttling back construction in the South while pushing it forward in the Northeast.

What is ahead for housing?

Purchasing a home is especially difficult right now because of high mortgage rates. These high rates gum up the gears of the housing market, leading to fewer sales and more modest price appreciation like the Case-Shiller Index showed today. For savvy and equity-rich buyers, though, this provides an opportunity to take advantage of relatively weak prices and an ever-growing set of options. Buyers without the ability to self-finance, especially first-time buyers who don’t already have equity in a home they could sell, will continue to struggle to find opportunities even as prices moderate. First-time buyers or existing owners looking to make a move would do well to target some of the markets we feature in our Top Housing Markets for 2025, which highlights several Southern and Western metros where we expect sales and prices to pick up in the coming year.

What does the data show?

The S&P CoreLogic Case-Shiller Index picked up slightly in October, recording a 3.6% year-over-year gain in the prices of homes in the US. This is a bit below last month’s mark of 3.9% growth and comes in as the 7th consecutive month in which year-over-year gains have fallen. With that being said, the index also reached a new record high for the 17th month in a row. Home price appreciation seems to be settling into a more comfortable pace, just as inventory levels pick up going into 2025: welcome news for prospective buyers who continue to face the headwinds of high mortgage rates. The 10- and 20-City Composites behaved similarly to the national index, with the 10-City posting 4.8% year-over-year growth (down from 5.2% in the previous month) and the 20-City coming in at 4.2% (4.6% last month).

How did trends vary by region?

Home price appreciation varies significantly across the country. In the South and West regions, where housing inventory has nearly returned to pre-pandemic levels, the Case-Shiller Index shows markets like Tampa (+0.39%), Denver (+0.44%), and Dallas (+0.85%) with less than a percentage point of year-over-year price growth. Meanwhile in the Northeast and Midwest, markets like New York (+7.27%) and Chicago (+6.24%) are driving the national-level price growth. Home builders have taken notice of this trend, and are throttling back construction in the South while pushing it forward in the Northeast.

What is ahead for housing?

Purchasing a home is especially difficult right now because of high mortgage rates. These high rates gum up the gears of the housing market, leading to fewer sales and more modest price appreciation like the Case-Shiller Index showed today. For savvy and equity-rich buyers, though, this provides an opportunity to take advantage of relatively weak prices and an ever-growing set of options. Buyers without the ability to self-finance, especially first-time buyers who don’t already have equity in a home they could sell, will continue to struggle to find opportunities even as prices moderate. First-time buyers or existing owners looking to make a move would do well to target some of the markets we feature in our Top Housing Markets for 2025, which highlights several Southern and Western metros where we expect sales and prices to pick up in the coming year.