Key Takeaways:

- Bitcoin slumped more than 2% in the past 24 hours to dip below the $101,000 level before partial recovery.

- Nearly $1 billion worth of crypto long positions were liquidated, affecting more than 220,000 traders across the world.

- Market mood damped by heightened geopol tensions and big publicrows between key influencers.

Bitcoin’s latest price crumble rattled the market, leading to huge liquidations and a frenetic trading session. This story explores the factors at play here, the size of liquidations under way and how wider geopolitical forces are shaping behavior among crypto investors.

Read More: Crypto Bull Run Phase 3 Ignites as Elon Musk Cuts Political Ties – Are You Ready?

Bitcoin Price Tumbles, Triggers Massive Liquidations

Less than 24 hours earlier, Bitcoin’s price plummeted from about $105,000 to nearly $100,900, falling below an important psychological level for just a moment. This crash triggered a chain of forced liquidations throughout crypto derivatives markets, liquidating nearly $1 billion worth of leveraged long positions.

Liquidation Breakdown

Almost 228,000 traders were liquidated during this time, incurring $985 million worth of losses, analytics firm Coinglass said. Longs suffered the most damage with $889million in liquidation value being wiped out, while shorts lost $97million.

Among them was a single liquidation on BitMEX’s largest instrument, the Bitcoin perpetual contract (XBTUSD), with a position size of around $10 million. These figures demonstrate just how volatile and risky leveraged crypto trading can be during rapid market moves.

Volatility Driven By Geopolitical And Market Conditions

The steep decline in prices didn’t occur in a vacuum. A number of macroeconomic and geopolitical factors helped drive up investor anxiety:

- Renewed US-China Trade Tensions: In a clear shot out of the blue for the markets that Donald Trump intends to run tough on China, all risk assets are falling out of bed on the back of renewed trade tensions, a factor that shouldn’t be ignored when it comes to getting an overall sense of where cryptos are heading. Investors like to cut risk fast in uncertain times, so that often results in quick selloffs.

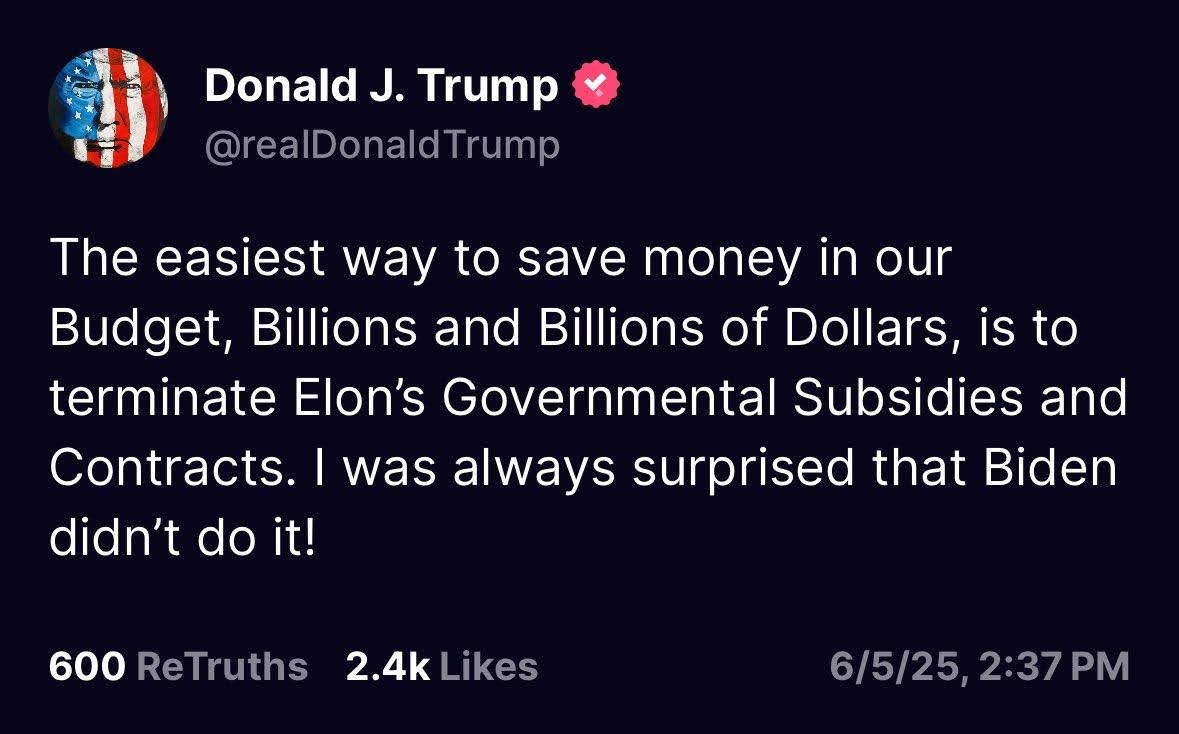

- High-Profile Public Feud: The highly-publicised battle of words on Twitter between Tesla chief Elon Musk and US President Donald Trump only added to market nervousness. Musk’s public claims tying Trump to sealed legal documents only made more headline s and ratcheted up investor anxiety.

These outside headwinds have converged on an environment well suited to sharp price adjustments and greater market fluctuations.

The Volume of Exchange Increases with the Price Drop

Stereotypically, the trading volume of Bitcoin exploded by 36.6% during that period, or $60.4 billion in volume. Such a spike indicates that the price decline prompted a spike in trading, as traders raced to close out existing positions in the volatile market, or establish new ones.

Despite the sell-off, Bitcoin’s market capitalization is still heavyweight, sitting at approximately $2.03 trillion, with almost 19.9 million BTC in circulation. This further illustrates that despite the rocky markets, investors are still keen to hold the asset and that it is very liquid.

The Impact of Leverage and Liquidations on Market Dynamics

Leveraged trading will magnify market moves: When prices plunge, traders who borrow capital to take bigger positions face automatic liquidation when the value of their collateral falls below certain levels. But, this can provoke a domino effect where liquidations create a downward pressure on the price, which in turn fuels further liquidations.

Such an amount of liquidations — close to $1 billion — shows just how important it is to manage risk and size your position properly while trading in crypto. The drop caught many traders by surprise for both its speed and magnitude.

What This Means for Crypto Investors

Here’s how market watchers and institutional investors are watching how external events are affecting the crypto market mechanics. The recent pullback and avalanche of liquidations could lead to short-term pain, but could to offer investors who can handle volatility opportunities in the long run.

- Risk Awareness: Traders using leverage should remain cautious, as sudden geopolitical developments can swiftly reverse bullish trends.

- Volatility as Opportunity: Higher volume and liquidation incident can bring buying opportunities to long term holders when panic subsides.

- Sentiment Sensitivity: Crypto markets remain highly reactive to global news and social media, more so than traditional assets. This means sentiment can rapidly shift, influencing price action disproportionately.

Could Bitcoin Stabilize Soon?

While Bitcoin’s price is currently under pressure, technical analysts point to strong support zones near $100,000, suggesting potential stabilization in the coming days. Additionally, with institutional adoption growing and on-chain metrics showing healthy network activity, the dip may be temporary.

However, caution prevails as unpredictable geopolitical developments could prolong volatility. Traders and investors should stay informed about both crypto-specific signals and broader macroeconomic news.

This market event is a reminder of the complexities and risks involved in cryptocurrency trading, especially under high leverage conditions. Staying updated with timely news and maintaining disciplined trading strategies is crucial for navigating this rapidly evolving landscape.