Business

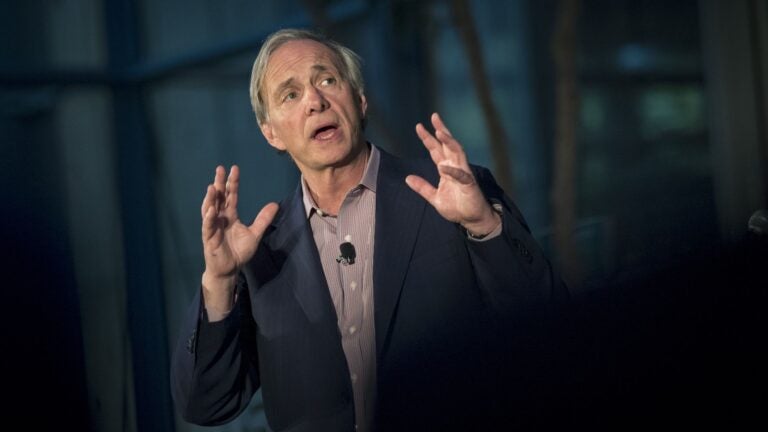

Ray Dalio, founder of the hedge fund Bridgewater Associates, says he’s “worried about something worse than a recession.”

An American billionaire, founder of the world’s largest hedge fund, Bridgewater Associates, and predictor of the 2008 financial crash is sounding the alarms.

On NBC’s “Meet the Press” Sunday, Ray Dalio said he’s “worried about something worse than a recession” if President Donald Trump does not manage the tariffs well.

During the interview and in an earlier essay on X, Dalio explained how an imbalance in monetary and world orders can lead to something more disastrous than a recession.

He said Trump’s handling of the tariffs to bring in more tax revenue and build new factories in the U.S. is “very disruptive.”

So far, it has been “like throwing rocks into the production system,” Dalio said. “Those impacts would be enormous in terms of the efficiency for the whole world at a great cost.”

When asked if the U.S. would dip into a recession when two consecutive quarters of negative gross domestic product (GDP) occur because of the tariffs, Dalio said the country is “at a decision point.”

Harkening back to the 1930s, Dalio, a Harvard Business School graduate, said he has studied history, which tends to repeat itself.

On X, he said that people are overlooking the critical forces driving the economy besides tariffs.

He laid out five forces driving the economy:

- The country’s growing debt problem

- The internal political conflict between the left and right

- International conflicts and a move to an “American first” approach

- Natural disasters like droughts, floods, and pandemics

- Changes in technology, such as AI

Dalio said changing any of the forces would be turbulent and, depending on how it is handled, could produce something “much worse than a recession.”

He suggested that one way to avoid a financial crisis would be to lower the national deficit to 3% of the country’s GDP, which measures the country’s economic activity. Congress must work together and pass a bipartisan plan to make that happen.

Experts say that too much debt can hurt the economy and make it more expensive for the government to borrow money. Managing deficits can ensure long-term fiscal stability and prevent potential crises. However, others say there isn’t a limit to government debt and debt growth because the country can always print the money to service its debts.

Dalio also suggested using America’s strength to negotiate inefficient policies and conflicts that don’t create disruption but “get us through this in an orderly way. ”

“We are seeing a classic breakdown of the major monetary, political, and geopolitical orders,” Dalio warned on X before Trump’s temporary reductions in the tariff increases. “This sort of breakdown occurs only about once in a lifetime, but they have happened many times in history when similar unattainable conditions were in place.”

Beth Treffeisen is a general assignment reporter for Boston.com, focusing on local news, crime, and business in the New England region.

Sign up for the Today newsletter

Get everything you need to know to start your day, delivered right to your inbox every morning.

Business

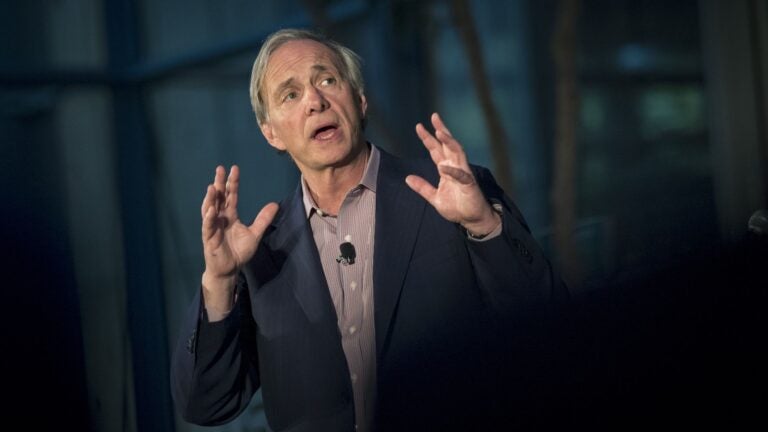

Ray Dalio, founder of the hedge fund Bridgewater Associates, says he’s “worried about something worse than a recession.”

An American billionaire, founder of the world’s largest hedge fund, Bridgewater Associates, and predictor of the 2008 financial crash is sounding the alarms.

On NBC’s “Meet the Press” Sunday, Ray Dalio said he’s “worried about something worse than a recession” if President Donald Trump does not manage the tariffs well.

During the interview and in an earlier essay on X, Dalio explained how an imbalance in monetary and world orders can lead to something more disastrous than a recession.

He said Trump’s handling of the tariffs to bring in more tax revenue and build new factories in the U.S. is “very disruptive.”

So far, it has been “like throwing rocks into the production system,” Dalio said. “Those impacts would be enormous in terms of the efficiency for the whole world at a great cost.”

When asked if the U.S. would dip into a recession when two consecutive quarters of negative gross domestic product (GDP) occur because of the tariffs, Dalio said the country is “at a decision point.”

Harkening back to the 1930s, Dalio, a Harvard Business School graduate, said he has studied history, which tends to repeat itself.

On X, he said that people are overlooking the critical forces driving the economy besides tariffs.

He laid out five forces driving the economy:

- The country’s growing debt problem

- The internal political conflict between the left and right

- International conflicts and a move to an “American first” approach

- Natural disasters like droughts, floods, and pandemics

- Changes in technology, such as AI

Dalio said changing any of the forces would be turbulent and, depending on how it is handled, could produce something “much worse than a recession.”

He suggested that one way to avoid a financial crisis would be to lower the national deficit to 3% of the country’s GDP, which measures the country’s economic activity. Congress must work together and pass a bipartisan plan to make that happen.

Experts say that too much debt can hurt the economy and make it more expensive for the government to borrow money. Managing deficits can ensure long-term fiscal stability and prevent potential crises. However, others say there isn’t a limit to government debt and debt growth because the country can always print the money to service its debts.

Dalio also suggested using America’s strength to negotiate inefficient policies and conflicts that don’t create disruption but “get us through this in an orderly way. ”

“We are seeing a classic breakdown of the major monetary, political, and geopolitical orders,” Dalio warned on X before Trump’s temporary reductions in the tariff increases. “This sort of breakdown occurs only about once in a lifetime, but they have happened many times in history when similar unattainable conditions were in place.”

Beth Treffeisen is a general assignment reporter for Boston.com, focusing on local news, crime, and business in the New England region.

Sign up for the Today newsletter

Get everything you need to know to start your day, delivered right to your inbox every morning.